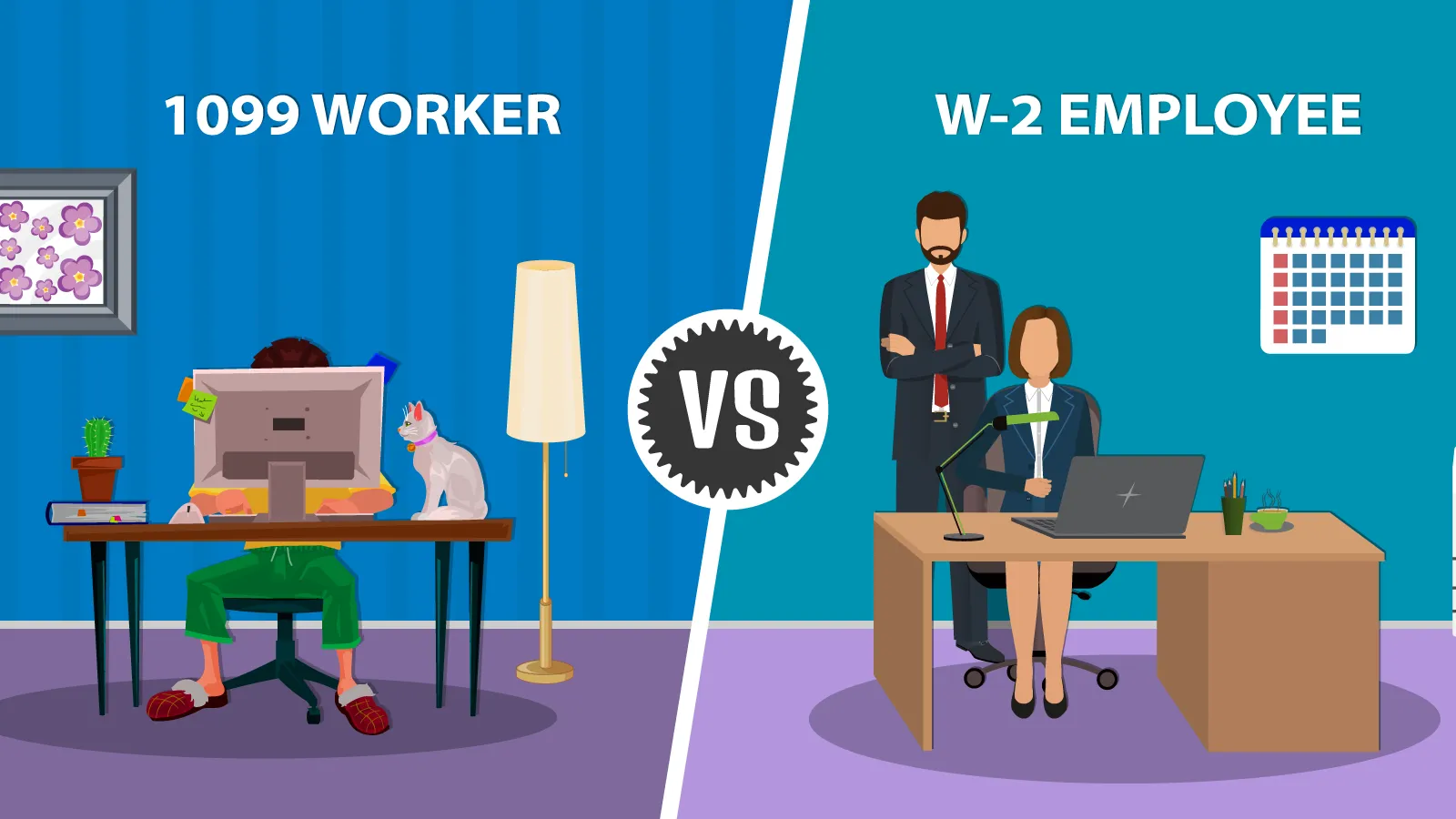

When businesses begin to hire, they often face the decision of whether to bring on employees as traditional W-2 workers or as independent contractors using 1099 forms online. This choice is not merely a matter of paperwork; it has significant implications for both the employer and the worker. In this article, we will delve into the six key differences between 1099 and W-2 workers to help businesses and workers make informed decisions.

Table of Contents

1. Tax Implications

For Employers

With W-2 employees, employers are responsible for withholding federal, state, and local taxes from their employees’ paychecks. They also pay a portion of Social Security and Medicare taxes.

For 1099 workers, employers do not withhold taxes. Instead, the responsibility for paying these taxes falls on the independent contractor.

For Workers

W-2 employees have their taxes automatically deducted from their paychecks. On the other hand, 1099 workers need to manage their own tax payments, often making quarterly estimated tax payments to the IRS.

2. Benefits and Protections

Employee Benefits

W-2 employees often receive benefits like health insurance, retirement plans, and paid time off. These benefits can significantly add to the total compensation package.

Legal Protections

Federal and state labor laws, including minimum wage, overtime, and workplace safety regulations, protect W-2 workers. 1099 workers do not receive these protections and are treated as self-employed individuals.

3. Control and Flexibility

Work Schedule

Employers have more control over the schedules of W-2 employees, dictating when and where they work. In contrast, 1099 workers typically have more flexibility, deciding their own work hours and locations.

Job Duties

While employers can specify the outcomes they want from 1099 workers, they cannot dictate the methods or processes used to achieve those outcomes. With W-2 employees, employers have more control over how tasks are completed.

4. Job Duration and Security

W-2 employees often have ongoing employment with a company, leading to a sense of job security. 1099 workers, however, are typically hired for specific projects or durations, and their work can be more sporadic.

5. Equipment and Expenses

1099 workers usually provide their own tools, equipment, and resources needed to complete a job. They also bear the costs of these tools and any associated expenses. W-2 employees, on the other hand, are often provided with the necessary equipment by their employer.

6. Training and Development

Employers often invest in training and development for their W-2 employees to enhance their skills and knowledge. This is less common for 1099 workers, who are expected to already possess the necessary skills and expertise for the job.

Final Thoughts

Choosing between 1099 and W-2 workers is a significant decision for businesses. It’s essential to understand the differences and implications of each classification. For workers, knowing the distinctions can help in negotiating terms and understanding rights and responsibilities. As the workforce continues to evolve, staying informed about these classifications will remain crucial for both employers and workers.