AU Small Finance Bank is an Indian Commercial Bank. Establish in 1996, the AU Small Finance Bank was Founded as a vehicle finance company, and Later It was transformed into a small finance bank. The Bank offers Various Banking and Financial Services to its Customer which also Include au bank net banking.

100+ banking and non-banking services, the AU Small Finance Bank Customers can Access their Bank Account 24×7 using their Internet Banking Account. Earlier Customer Had to Visit their Branch and Stand in Long Queue for hours for Basic Banking services. With this Simplified Digital Banking, Internet Banking Has Become one of the popular banking programs.

Table of Contents

Benefits of Using the AU bank Net banking Services

- Fund transfer – Fund Transfer with online Banking is much More Easier than Visiting the Branch and Standing in Queue for Hours. AU Bank Net Banking Allows Fund transfer using NEFT, RTGS, and IMPS Services. Customers can transfer Fund online to own or third Party Bank Account without any Hassel.

- Check Account Balance – Check Your Account Balance without stepping out of your house. You can check Your Account Balance and view records of your Debit and credit transactions.

- Bill Payments – Pay Your Electricity, Water, or Prepaid Mobile Bills using the Internet Banking.

- Tax Payment – Tax Payment is one of the great advantages of online banking. Internet Banking Allows You to Pay Your income and other Business taxes online. Most of the Banks also provide Tax Support to their Account Holders.

- Open FD / RD – Fixed Deposits and Recurring Deposits are one of the Best Ways to Invest Money for Longer Time. Before opening an FD or RD Account, You have to Visit the Bank and Get in touch with Bank Executive to Process all Your Documents. With Internet Banking, you can simply log in to Your Account and Apply for New FD or RD Account.

- Secure Banking – Unlike Traditional Banking, there is No Risk of thief or fraud in online Banking. Most of the Internet Banking Portals are Secured by Two-factor Authentication for Extra security.

How to register for AU Bank Net Banking? Step by Step Guide

All Access all the Services offered by AU Internet Banking, You have to first complete the one-time Registrations Process. The Registrations can be done online and offline.

For Offline Registrations, You can Visit Your Nearest AU Small Finance Bank with Documents Like Aadhar copy and passbook Copy. Get in touch with the Bank Executive and Ask for the Net banking Registrations Form. Fill in all the Details Properly and Submit the Form Bank to Branch.

The Bank will process all the Documents Properly and Provide You an internet Banking Welcome Kit. The Internet Banking with Your Account will be Activated within 24 Hours of Submitting the Form. For online Registrations, You can Follow the Steps Mentioned Below.

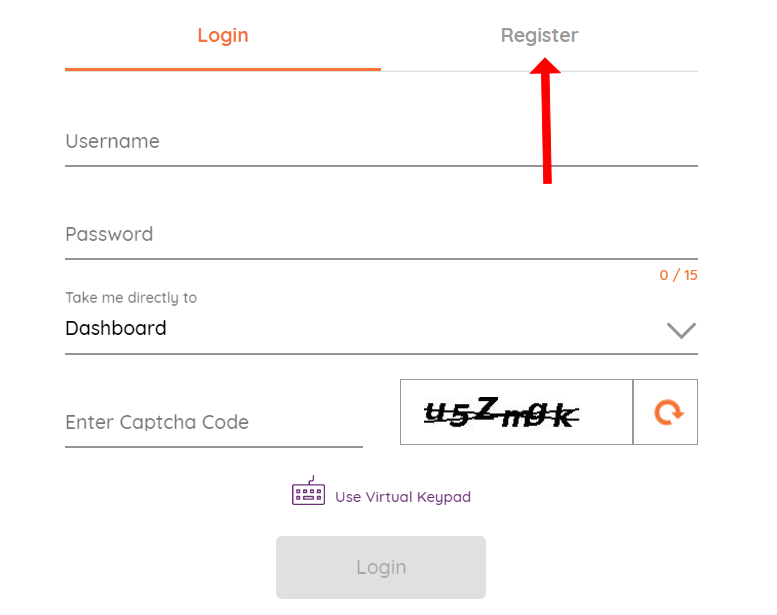

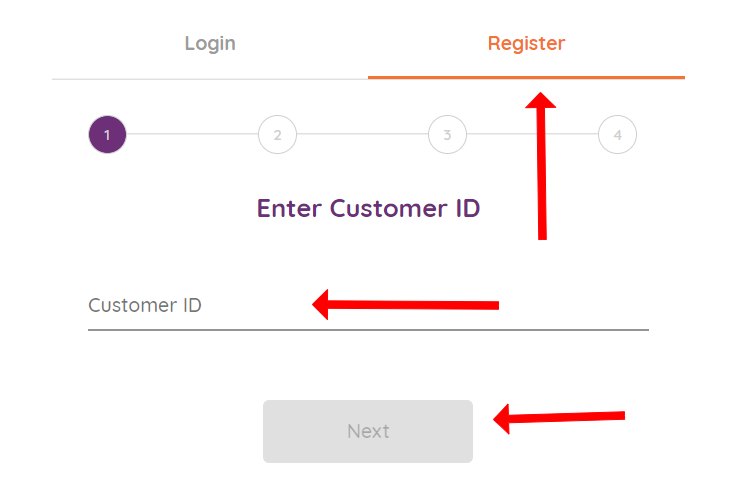

- Visit the official Website of AU Bank Net Banking & Click on Register.

- Enter Your Customer ID and click on Next to Further Process.

- Select Registrations using the Debit card or Account Number ( We have used the Debit card for Registrations )

- Enter Your Debit card Number & 4 Digit PIN and click on Next.

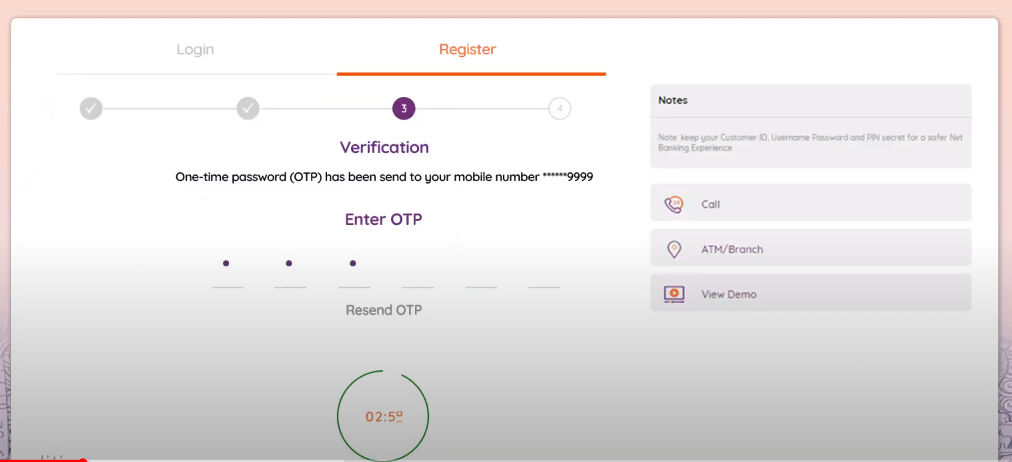

- You will receive an OTP on Your Registered Mobile Number. Enter the OTP and click on Next.

- Next, You have to set a password for Your Net Banking Account.

- Set Security Question & Next Set a username for Account.

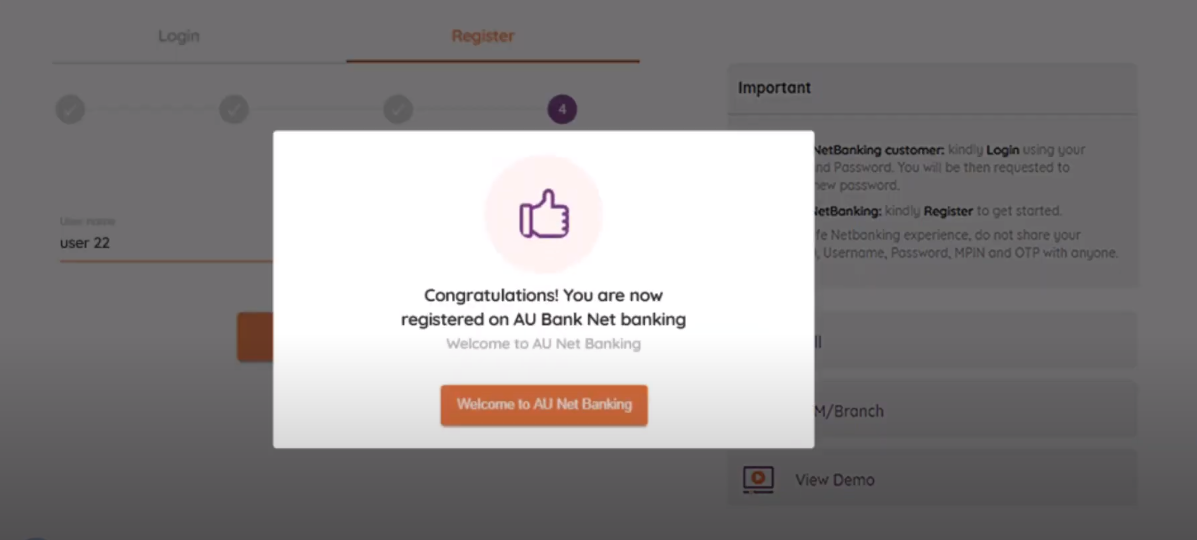

- A Successful Registrations Message will be shown on the screen. You can Start using the AU Bank Net Banking Services By into Your Account.

AU Bank Net Banking Login in 3 Simple Steps

Once You have completed the internet Banking Registrations, now You can log in to Your Account by entering your username and password as set in earlier steps.

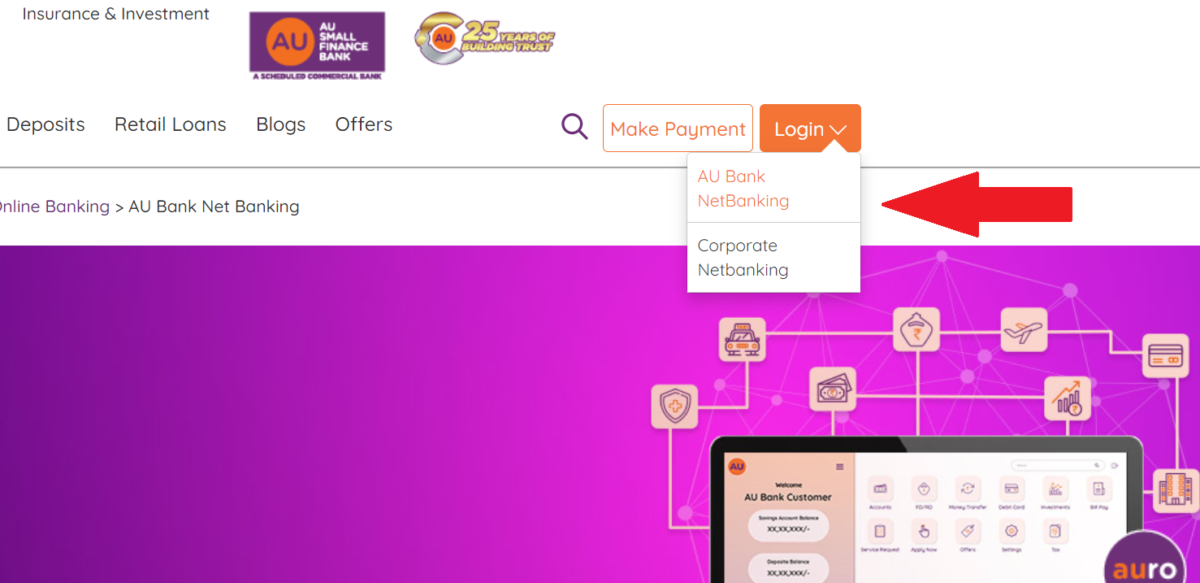

- Visit the official Website of AU Bank Internet Banking.

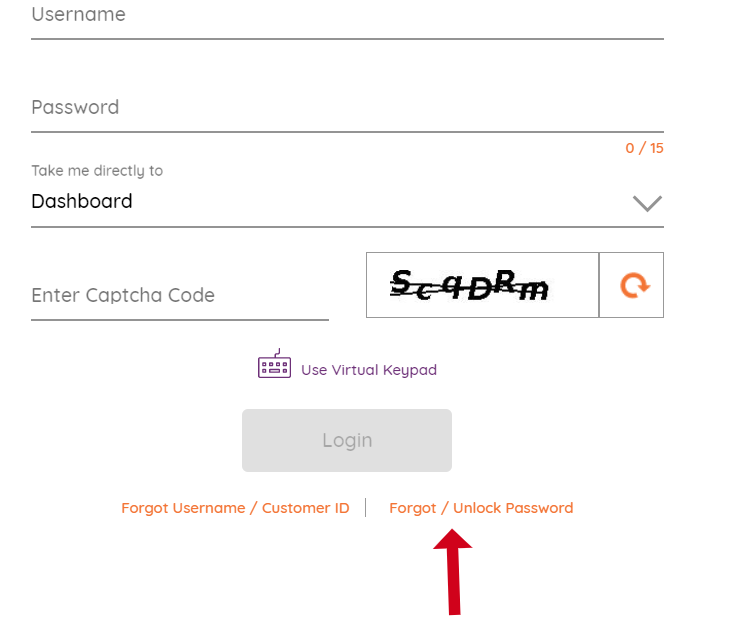

- Enter Your username, Password, Select Where You want to land on Your Net Banking Account, and Enter the Captcha.

- Once You have Entered all the Details, Now click on Login.

Note – Make sure You do Not Share Your internet Banking Account Password with anyone. Also, Try to Avoid any Public Internet cafe to Login into Your Accounts.

How to transfer using the AU Bank Internet Banking?

- Login to Your AU Bank Online Banking Account with Your username & password.

- Navigate to the transfer Fund option in Menu.

- Select the Beneficiary Account and If you have not added the beneficiary, click on ‘Add Beneficiary’.

- Enter Beneficiary Name, Account Number, Bank Name, IFSC Code, and add the Beneficiary to Your Account.

- Next Enter the Amount You want to transfer.

- You will receive an OTP on Your registered Mobile Number. Enter the OTP to Authenticate The Process.

- Confirm to Transfer the Amount. Save the Receipt for any future Usage.

How to reset password in AU Bank Net Banking?

If You Have Forgotten Your online Banking Password or want to reset it for security reasons, You can Follow the Simple Guide Mentioned Below.

- Go to the official Website of AU online Banking.

- Navigate to Login Button in Menu.

- If You are a retail banking user, Select AU Net banking. The Corporate user will Select Corporate Net Banking.

- On the Login Page, click on Forget password.

- Now Follow the Steps Mentioned on the Screen and Reset Your password.

How does Internet banking work in AU Small Finance Bank?

- The Customer First completes the Time Registrations Process for Net banking.

- The bank provides a unique username and password to the Customer to operate Their Accounts.

- The account holders Login to their account using the login credentials and access the Different Services Offered by the Bank via Online Banking.

FAQ ( AU Small Finance Bank Internet banking )

Who can apply for AU internet banking?

Anyone having a Savings or Current Account with AU Small Finance Bank can Apply for Net Banking.

What are the Charges for an online fund transfer?

For NEFT and RTGS, there are No Service Fees. Transfer done by IPMS Is Liable for Rs. 5 per transfer.

What is the Limit for online Fund Transfer?

For NEFT the Maximum Limit is Rs. 10,00,000 and for RTGS the Maximum Limit is Rs. 10,00,000.

How to check recent transactions of my Account?

Login to your Net banking Account and click on Accounts to check Your recent transactions.

Can I Apply for IPOs through Net banking?

Login to Your Account and click on Investments. Select IPOs and you will be redirected to iposmart.aubank.in. Select the IPO You want to invest in and click on Apply.

In Conclusion

AU small Finance Bank is one of the Major Banks in the Country. With the offering of Internet banking services, the Customers can Access the Bank Account from the comfort of their sofa.

We Hope this Article Clears all Your Queries related to AU Bank Net Banking. If You Have any Question Related to Net banking registrations or log in, you can Get in touch with AU Customer care 1800 1200 1200. You can also share the Queries with us in the comments below.

ALSO, READ | How to Unblock SBI ATM Card?