Table of Contents

What is Demand Draft or DD?

DD or Demand Draft is a negotiable instrument issued by the Bank, such as Chase Bank, to a client. The person who is Requesting the DD from the Bank is Know as the Drawer and the Person whose Name is Issued is Known as Drawee and the receiving Party is Payee. In this article, We have Discussed the Latest SBI DD Charges.

To Understand DD Better we can also Compare it to Cheques. However, we can only Pay Demand Drafts to a specified party. In Countries Like the USA, the remotely created cheques are also Known as Demand Draft.

- Also, read – How to Unblock SBI ATM Card?

Before requesting any Demand Draft From the State Bank of India, You know the Latest DD Charges in SBI. Let’s take a look at demand draft Charges and other Details.

What are the SBI DD Charges?

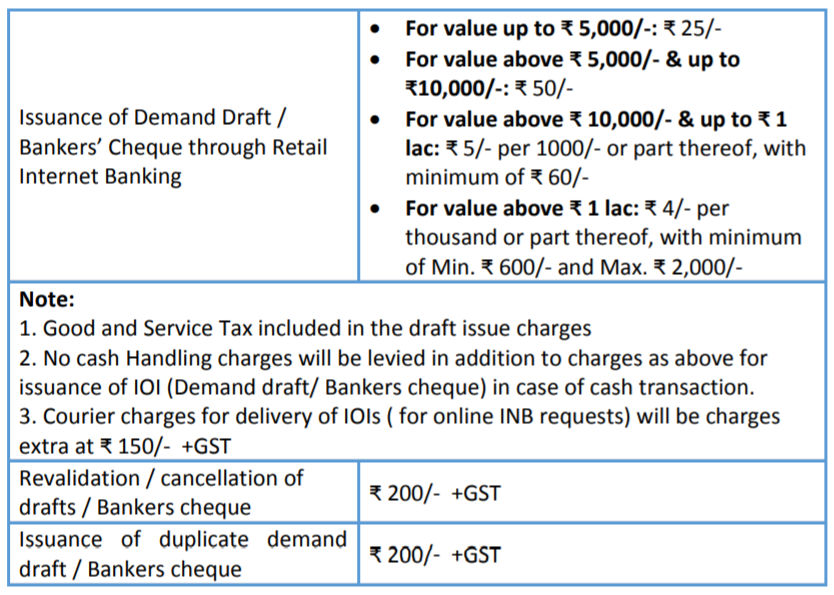

Every Public and Private Sector Bank has Different Rates for Requesting Demand Draft. The DD Fee is Charged as per the Amount of the Demand Draft.

- The Charges of Demand Draft of up 5000 INR is Rs 25

- From Rs. 5,000 to Rs, 10,000 the DD Fees is Rs 50

- The Demand Draft Charges From Rs. 10,000 to Rs. 1 lakh is Rs.5 per Rs.1000

- For an Amount above Rs.1 lakh, The SBI DD Charges are Rs.4 per thousand with a minimum of Rs.600 and a Maximum of Rs.2,000.

All the Latest Demand Draft Charges Mentioned Above are inclusive of GST. You Do Not have to pay any other fees other than the DD Charges.

In Conclusion

The Demand Draft issued by the State Bank of India is Valid for 3 Months. If You Do Not Present the DD Within the period, it will Automatically Get Expired. After 3 Months if You can Reapprove Your DD by Paying small Fees of Rs.200+GST to the Bank.

We Hope this Article Helped You to Know more about the SBI DD Charges. If You want to know more about the Different Services Charges of SBI in Detail, You can Visit this Page Here.