DeFi market maker has revolutionized the way we buy and sell cryptocurrencies. In the process, it has also democratized liquidity provision by leveraging innovative solutions to existing problems. One of these is the use of automated market makers (AMMs). This type of exchange is not widely used outside of the DeFi industry, but it’s important to understand how they work because they’re integral to ensuring a smooth DeFi experience.

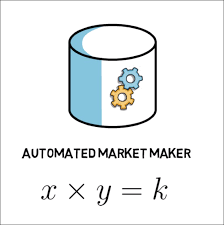

AMMs are a new model for liquidity provision that has revolutionized how cryptocurrencies are traded on DEXs. This model replaces the traditional order books used on most exchanges with crowdsourced liquidity pools. It also allows for automated trading and price discovery.

The first AMM-based DEX, Uniswap, launched in 2018. Since then, it has quickly become the poster child of DeFi liquidity and is running trade volumes in the billions of dollars each day.

This democratized model of liquidity has been made possible by the introduction of AMMs, which allow users to pool their idle tokens into liquidity pools that are then matched with traders and LPs who want to trade them. This allows users to earn trading fees by supplying liquidity for other traders while also earning from a proportion of each transaction fee.

When a user deposits a certain amount of tokens into a liquidity pool, they must supply an equal amount of liquidity to the other members of the pool. This ensures that there is always sufficient liquidity available on the network to meet demand and avoid a situation where traders are not able to access the market at all.

Using AMMs to Incentivize Liquidity Mining

AMM-based decentralized exchanges like Uniswap, Sushi Swap, Pancake Swap and Balancer reward liquidity providers by allowing them to earn a percentage of each transaction fee paid out to the participants in their pools. They also offer free tokens to these users, which is a great incentive for them to supply liquidity to the exchange’s pools.

Another advantage of AMM-based exchanges is that they are scalable and can handle a high volume of transactions in a very short amount of time. This is essential for a rapidly growing crypto ecosystem like DeFi that requires rapid volume and price changes to be able to attract users.

It is also worth noting that these AMM-based exchanges do not have to pay a large amount of gas fees, which in turn reduces their operating costs. This has allowed them to be much more competitive than their counterparts in the traditional world, and their success is a testament to their ability to innovate at breakneck speeds.

They have also been able to scale their systems to accommodate a large number of transactions, and their speed is unmatched by traditional exchanges. This means that they can process billions of dollars worth of transactions each day, while offering a much better user experience.

AMM-based decentralized exchanges are a vital part of the DeFi ecosystem and have helped democratize liquidity provision on the platform, but they are not the only solution to the challenges facing DeFi. As a result, DeFi has been experimenting with other approaches to liquidity provision, including solutions such as DODO, CoFiX and Bancor. These projects are all looking to further enhance the functionality of AMM-based exchanges, and reimagine the concept of liquidity provision in ways that align more closely with the ethos of DeFi.