Table of Contents

Introduction

No-credit loans have become widespread in recent years, particularly in North America. This could result from the region’s declining economic prospects, rising inflation, and a surge in unplanned expenses, among other things.

The fact that the economy is founded on a credit system that can be very challenging to fix when it fails also doesn’t help. This suggests that people with weak credit frequently struggle to get financing options.

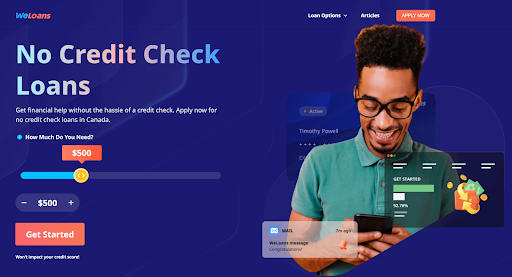

WeLoans, a well-known online payday loan broker, thankfully provides Canadians with a mouthwatering disposition by offering a variety of loan options, including installment loans, payday loans, bad credit loans, and no credit check loans.

What are no credit check loans?

As the name suggests, a no-credit-check loan is a sort of loan for which the loan company does not do a credit check. These kinds of loans give potential borrowers with poor credit who nevertheless need financing a second shot.

No credit payday loans are offered by WeLoans with a maximum lending amount of $1,500 (Canadian) and quick repayment terms. WeLoans provides other options including installment loans and loans for people with terrible credit, the latter of which is tailored to the requirements of potential borrowers with bad credit and requires a predetermined repayment period for a specified loan amount.

Given the ubiquity of the problems caused by unexpected bills in Canada and the North American region, the advantages of these loans are exponential. Prospective loan recipients can now get these loans within a few minutes of applying thanks to a simple application process and even quicker loan payout times.

How do no credit check loans from WeLoans work?

WeLoans’ no-credit-check loans give borrowers who would prefer to forego the process of thorough loan checks an unrestricted experience. Prospective borrowers must be eligible for WeLoans’ no-credit-check loans and take these actions in order to access them.

Fill out an Application Form: To begin, a potential borrower must accurately complete the online application form on the WeLoan website. This information will be used to gauge the lender’s risk tolerance and the amount of financial help that will be provided to the borrower.

Compare Offers: Through WeLoans, borrowers can obtain some of the most enticing no-credit-check loans with the greatest terms available thanks to an enormous network of eager lenders with stellar credit histories.

Because there are more lenders, there is more competition, thus the loanee can use WeLoans to compare many offers from different lenders and choose the one with the best terms.

Access Loan Disbursement: The loan will be released to the account number and information provided by the potential loanee during the application process once an offer has been accepted by the loanee.

After accepting an offer, loan recipients can receive their funds through WeLoans 24 hours later. All of WeLoans’ loans have the same application process, not just payday loans, and you can know several different loan options from here.

As previously mentioned, only people who are eligible for no credit check loans from WeLoans may apply for those loans.

Here is a list of some criteria that must be met in order to qualify for these loans.

- The age of the loanee must be at least 18.

- The borrower must possess a current government-issued ID.

- Loan recipients must be Canadian citizens or permanent residents.

- Loan recipients must provide verifiable income documentation and payment records.

- Loanees are required to show a recent utility bill to prove their address.

- Every loan recipient is required to have an active bank account.

The following is a list of WeLoans’ no-credit-check loans:

WeLoans payday loans include a maximum loan amount of $1,500 and a minimum repayment term of 14 days.

A minimum of $100 and a maximum of $1,500 are also available with low-interest repayment schedules for installment loans. Credit card payments may be serviced with these loans.

Why we should apply for no credit check loan from WeLoans

- Accessibility: WeLoans provides a number of loan options designed to satisfy the requirements of the majority of potential borrowers. Loan alternatives like installment loans, payday loans, and bad-credit check loans give borrowers the chance to choose from a number of possibilities.

- Loan payback speed: WeLoans offers no-credit-check loan payouts in less than 12 hours. It’s important, nonetheless, that borrowers fulfill all eligibility conditions as applications for loans may be turned down or denied if all requirements are not met.

- Cosigners not required: As a risk management strategy, the majority of no-credit-check loan providers frequently require cosigners from loan recipients for such loans. A cosigner is not necessary for a free credit check loan from WeLoans.

- Numerous Offers: WeLoans boasts a long list of lenders, suggesting that there is frequently greater rivalry among lenders to offer loans. As more loan offers and more favorable terms are possible in this situation, loanees are frequently in a stronger position.

Conclusion

No-credit-check loans have become widely used by the public during the past few years. The current tough economic circumstances may be to blame for this.

Prospective borrowers with weak credit have a chance with WeLoans. Individuals with bad credit can get critical financial help based on their current verifiable income levels by providing no-credit-check loans to loanees and removing the requirement for a co-signer.

As long as they complete all qualifying standards outlined in this article, prospective loanees can contact WeLoans to receive a variety of loans, including installment loans, payday loans, and even loans for those with terrible credit.

WeLoans guarantees a more welcoming financial environment for everyone, but it’s important to remember that loans should only be applied for when absolutely necessary and utilized responsibly. Financial responsibility is still a crucial component, particularly for people with poor credit scores.