An AMM is a program that enables users to perform permissionless transactions. It does this by using a mathematical formula to determine the value of assets. These formulas can vary from protocol to protocol. In general, the formula aims to have 50:50 asset weights, but there are exceptions.

While AMMs are not a replacement for traditional exchanges, they do provide a new source of liquidity. One of the most common AMMs is called the Balancer. These systems help the Decentralized Finance industry to move forward by addressing the flaws of traditional market making. As a result, these systems are now able to offer a more reliable source of liquidity.

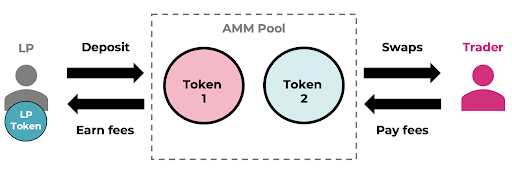

Liquidity pools are another feature of AMMs. These pools are formed by third-party participants, who deposit their cryptocurrencies in the pool in exchange for rewards. These liquidity providers are paid a share of the trading fees. This allows AMMs to offer larger swaps than would be possible without these pools.

Some AMMs are designed to be easy to use, while others are designed to be more sophisticated. The Balancer Protocol is an example of a complex AMM. It combines a price sensor and self-balancing features. Its unique structure makes it different from traditional investment funds. It is designed to give users more flexibility by creating a decentralized marketplace.

Automated Market Makers are a critical component of the Decentralized Finance (DeFi) industry. Although a complex concept, AMMs can be very user-friendly and have carved out a niche for themselves in the DeFi space. While many companies have entered the AMM space, only a few have carved out new solutions.

One of the best AMMs is Uniswap. It was the first to develop the AMM protocol and is a popular decentralized exchange. Its user-friendly interface and features are easy to use, allowing users to trade multiple assets without complication. Another advantage is its ability to connect a third-party crypto wallet.

Another benefit of the what is AMM is that the liquidity pool is permissionless. Anyone can participate, and the “k” value changes based on the chosen trading pair. Users who have extra crypto tokens can also provide liquidity to AMMs. By providing extra liquidity, they can earn crypto tokens in exchange.

Lastly, AMMs help participants to trade digital assets. Its platform is built on the Ethereum blockchain and has the ability to integrate with digital wallets. Some open-source AMMs include Metamask, Myetherwallet, and Balancer. As a result, these programs have many options to meet the needs of traders.

Automated Market Makers are a crucial part of the DeFi ecosystem. They help DeFi exchanges to provide liquidity to their users. This allows them to facilitate smooth and safe cryptocurrency trading.