Financial emergencies are a common occurrence in our day-to-day life. And often, we incur them when we have zero to minimal access to money. But thanks to the multiple lenders available today, you can easily get an emergency loan without even moving a muscle.

Unlike in the olden days, you don’t need to go to a conventional bank or lending firm to get a cash advance or loan. Online lenders have made this process so seamless that you can access money quickly whenever you have a financial emergency.

Although there are dozens of emergency loan lenders today, the big dilemma remains: “What are the most suitable options to consider? And how quickly can I get one?” If these are your concerns, you’re in the right place. Read on to learn the quickest way you can get online emergency loans.

Table of Contents

What are Emergency Loans?

Emergency loans are loans you can get quickly to cover urgent financial necessities. Access to these loans usually involves easy processing and swift disbursement (typically within 24 hours). Depending on your lender’s policies and requirements, they come with varying terms and conditions.

One fact about these loans is that lenders charge higher interest rates than other loan types. For instance, quick emergency loans tend to attract bad credit borrowers seeking fast cash who carry a high borrowing risk for lenders, leading to high-interest rates.

Additionally, emergency loans have a short repayment period as they are designed to help you cover sudden/unexpected expenses. Emergency loans are an ideal way to get quick cash, but before you start the process, it is essential to understand how they work.

Factors to consider before accessing an emergency loan

Before signing on the dotted line, you must consider several factors that may help you have a hassle-free borrowing experience. Here are the five leading factors to consider before accessing an emergency loan.

1. Loan Features

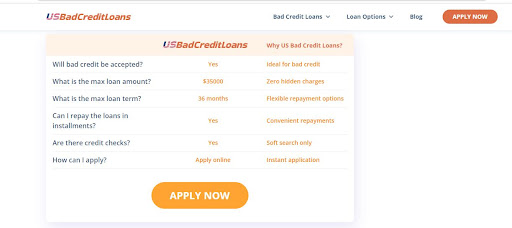

Different emergency loans come with various features. Loans with no late fees or prepayment penalties are ideal, as they provide you with better flexibility when you’re paying off the debt. Emergency loans with no credit check are also a great option, as they enable you to access fast cash without undergoing a detailed credit check. This way, you needn’t worry about impacting your credit score when you conduct a loan inquiry.

2. Repayment Period

Emergency loans typically have a short repayment period, but depending on your lender, you can get one with a repayment period of up to 36 months. Although having a longer repayment time translates to lower monthly payments, it’s better to opt for a loan with a shorter repayment period. More often than not, long-term emergency loans lead to more interest charges in the long run.

3. Disbursement Time

Borrowers seeking emergency loans always have an urgency to receive funding as soon as possible. Online lenders offer quick disbursements, often within the same day, whereas others may take a few days to pay out. On the other hand, conventional lenders such as credit unions and banks may take 3-5 days to release funds because they have more intricate and lengthier approval and funding mechanisms.

4. Interest rates

Lenders often set different interest rates for their emergency loans. Since the interest rate significantly impacts the final cost of the loan, it is imperative to search for the lowest rate you can get. If you have a bad borrowing history, you may need to select an emergency loan with a higher rate than you’d want.

5. Budget

Reviewing your budget to see if you can afford the fixed monthly loan payments is an important step before getting an emergency loan. If the monthly payments are too high, looking for a different option with a longer payment term or a smaller loan amount would be best.

How to Get an Emergency Loan Quickly

Nowadays, you can access emergency loans online within minutes by partnering with a reputable broker such as US Bad Credit Loans. They work by connecting you to a network of trusted lenders offering emergency and other loan types. Here is a step-by-step look at how you can access emergency loans using this website:

1. Submit your Information

First, you’ll need to submit your personal and contact details online. After that, your details will be sent to lenders specializing in emergency loans, who will respond within minutes.

2. Receive and Review Loan Offers

It’s common to get several offers from multiple lenders with different terms and conditions. Here, you’ll need to carefully review each loan offer before picking one that fits your criteria. Ensure you consider critical things such as the loan repayment period, APR, and other loan terms within the agreement.

3. Get funding

Upon agreeing to the loan agreement, your lender will transfer the money directly to your checking bank account as soon as possible. The time taken to complete the money transfer may vary depending on the lender you connect with online

Quick Alternatives For Emergency Loans

Apart from emergency loans, there are other online quick loan options on US Bad Credit Loans you can consider when you’re in dire need of quick money. Here are the top alternatives for emergency loans to consider.

1. Personal Loans

Personal loans provide more convenience and competitive interest rates than emergency loans. You can qualify for higher loan amounts with personal loans and receive the funds as soon as one day. Depending on your lender and creditworthiness, you may have to provide collateral or a guarantor when accessing personal loans.

2. Title Loans

Title loans can provide you with emergency funding if you own a clean car title. Title loans work by providing you with a quick loan after you offer your car title as collateral. Failing to repay title loans can lead to repossession of your vehicle.

3. Payday Loans

Payday loans are a great choice if you need quick cash and have a steady income source. These loans are short-term loans, and you need to repay them when you get paid next (within 2-4 weeks). Since these loans don’t involve a hard credit check, you can get your lender’s response in as little as 10 minutes.

4. Credit Card Advances

Credit card advances enable you to borrow a specified amount of money from your unused credit card balance and get it in cash. However, these loans tend to have high-interest rates and very short repayment periods.

Conclusion

Lenders need to take time to review your personal information and creditworthiness before you can get an emergency loan. You can get an emergency loan in as little as 24 hours from a reputable lender. In closing, kindly remember to stay on top of your emergency loan repayments to avoid additional fees.