In just two weeks into December, the cryptocurrency market has shown a tortuous change of explosive information volume. At the beginning of the month, Bitcoin price hovered from $36k to $39k, and then broke through $44k in one swoop. The rapidly rising market has made it difficult for both new and old players to continue their leisure time, and funds have flooded in.

However, last week, BTC drove most mainstream Altcoins and unexpectedly began a pullback trend. It is not uncommon for both long and short positions to sell out within a few days. However, there are also upstream factors, such as AVAX.

As an established public chain, creating strong growth rates is not easy. Previously, it was Solana, but now it seems that Avalanche will take over. We have also studied its important trends in the Gate blog before, especially in the field of RWA actions. For details, please refer to Avalanche Turning to RWA Track: Collaborating with JPMorgan Chase, Ecosystem Tokens Collectively Rise

Overall, the market value of AVAX has increased by 340% in the past two months, reaching $14.35 billion. Let’s take a look at what has attracted everyone’s attention to it.

Table of Contents

Technological Updates and User Engagement

The basic feature of Avalanche is a multi-chain framework composed of subnets of scalable networks. The main network includes P-chain, X-chain, and C-chain. P-chain management validator and subnet level functionality, X-chain management Avalanche native tokens (digital representations of real-world assets), and popular C-chain are implementations of Ethereum virtual machines.

Meanwhile, it adopts a special consensus mechanism, seeking consensus by soliciting a subset of validators, without the need for all nodes to record and synchronize all transactions, which improves efficiency and achieves greater throughput; These combinations achieve high performance, low latency, and scalability.

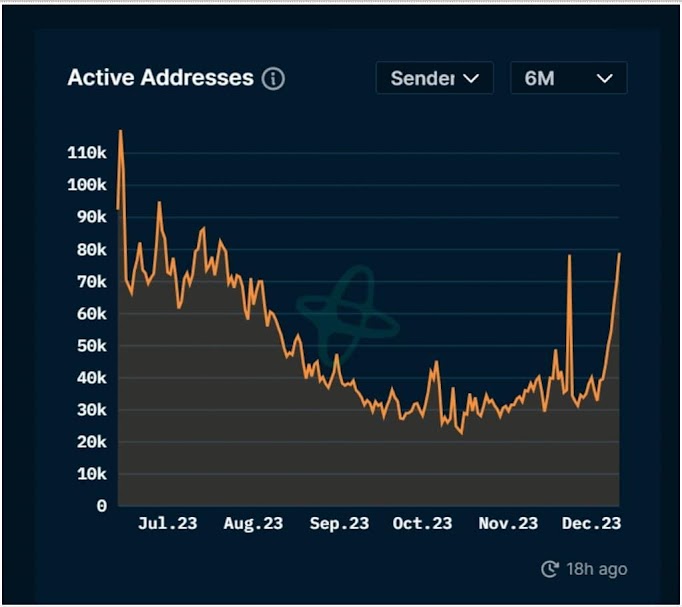

But with the emergence of more and more new narratives, these characteristics gradually become less prominent, and coupled with the fact that the community has been relatively inactive, Avalanche was quite sluggish the previous year. In order to improve widespread awareness and community activity, Ava Labs has also made a lot of efforts.

In terms of technology, including launching Cortina upgrades to provide developers with a better experience, proposing Astra upgrades to enhance the subnet architecture on Avalanche, and subsequently introducing “pay as you go” fees in AVAX, redesigning Cortina 14 for validator set management, etc. In terms of ecosystem construction, Avalanche has launched multiple support programs and tools and collaborated with traditional enterprises.

In addition to these promotions, the Avalanche Foundation has also launched Avalanche Vista, allocating up to $50 million to purchase its tokenized assets on the blockchain and promoting its role in on chain finance. This is undoubtedly the most practical and beneficial measure for players to experience.

As a result, more users have joined the development and governance, and the development activities on Avalanche continue to increase, which shares some similarities with the development of Solana; TVL also increases with the increase in price.

Ecosystem – Inscription, GameFi, NFT, DeFi

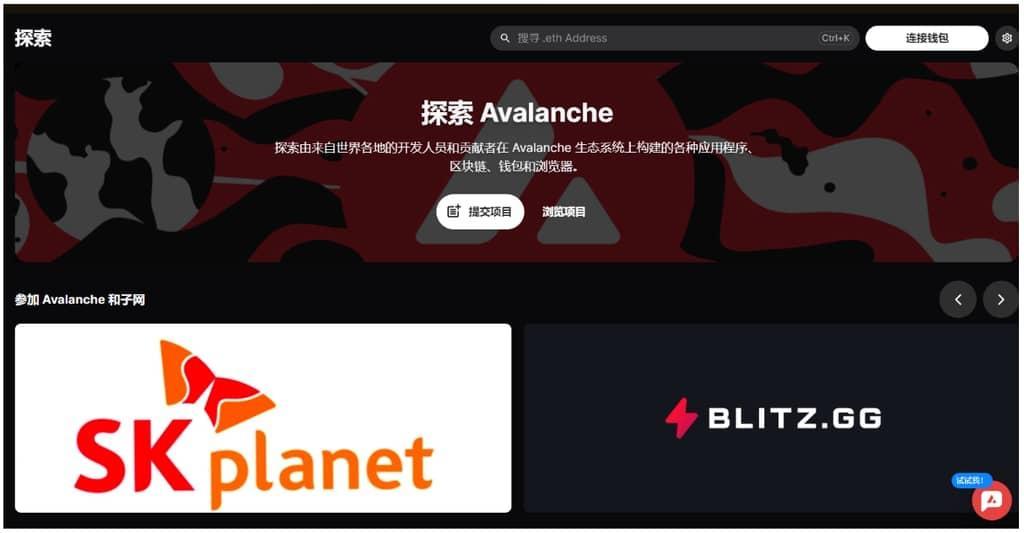

Avalanche hosts a large ecosystem consisting of dApps and protocols on its C-chain and subnets, where the Avalanche ecosystem can be intuitively explored.

It is evident that the ecosystem on Avalanche is thriving, with impressive performance in its mature field Defi, newly supported NFTs, gaming sectors, and more.

In terms of gaming, Korean game publishers have teamed up with Avalanche Arcad 3 to explore Web3 games through its Web3 branch, Intella X. This collaboration was announced at the 2023 Avalanche House Seoul Conference, aiming to enhance the Web3 gaming industry by leveraging Neowiz’s gaming experience and Avalanche’s Web3 features.

There are also many high-quality projects active in single player game projects, such as the recently popular 3A FPS game SHRAPNEL, which is also on Avalanche.

In terms of DeFi, Unisawp extends to the Avalanche C chain and achieves interoperability between Ethereum and Avalanche through LayerZero, enhancing its DEX ecosystem. This is a powerful combination that can bring the huge trading volume of Uniswap and innovative centralized liquidity models into Avalanche.

HyperSpace has also launched the NFT market and launch board on Avalanche, introducing real-time trading and analysis functions for NFT collectors, enriching Avalanche’s previously mediocre NFT ecosystem.

In terms of cooperation with traditional finance, Avalanche’s partners include but are not limited to JPMorgan Chase, Citigroup, etc., which naturally attracts high net worth users in the traditional finance field. Regarding the traditional finance and RWA fields, if interested, please refer to the article at the beginning of this article.

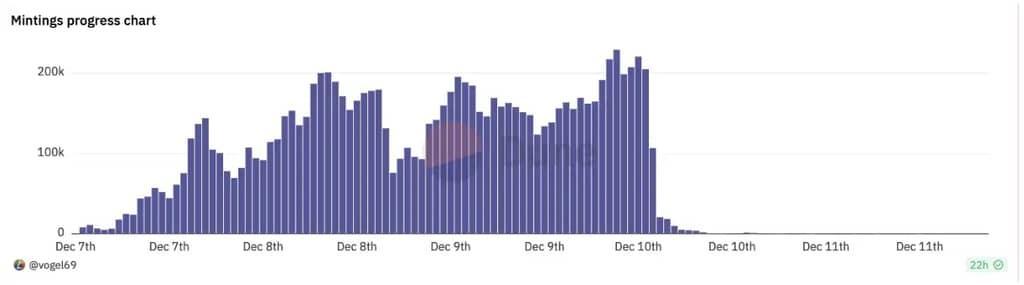

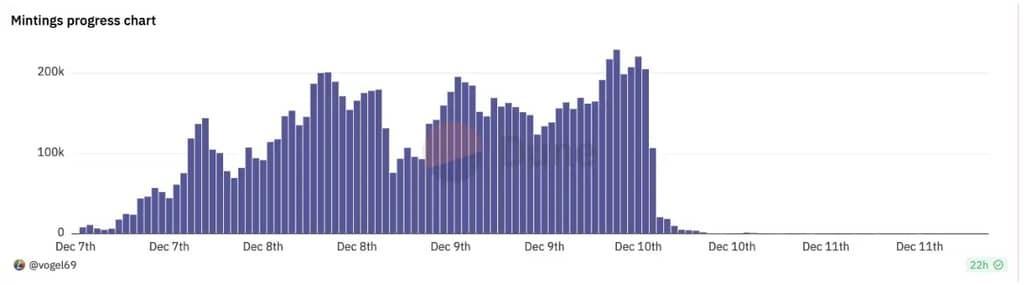

In addition, due to the recent trend of inscription assets in the market, public chains that can bear inscriptions are easily affected by FOMO. Avalanche, which has good network performance and low gas fees, is also a good choice. The casting cost of ASC-20 tokens is relatively low, which injects a lot of vitality into the network for a large number of inscription players.

Conclusion

It can be seen that the proactive actions of the Avalanche team, as well as the vision of collaborating with traditional finance and focusing on areas such as RWA and GamaFi, are quite insightful. In the short term, they have attracted the participation of numerous high-net-worth users and developers, resulting in astonishing growth in market value and TVL.

However, all of this is also based on its origin: a unique consensus mechanism, high throughput, and low latency subnet characteristics. Based on its underlying mechanism and current thriving ecosystem, Avalanche can go further, but as an investor, we must not be blind and always guard against potential risks.